Introduction

In our journey of building SimpleDirect, we've had our fair share of missteps, and jumping into building a B2C app was one of them.

It was 2021, and I'm here to take you through what happened, how it 'failed', what we learned from it, and how we're contemplating another go at a B2C offering with SimpleDirect soon.

Ideation and Building a Quick Prototype That Went to Market

Early spring of 2021 saw a 'fin-tech' frenzy sweeping through Silicon Valley and around the world. Neobanks, also known as challenger banks, digital banks, or online banks, are financial institutions that operate exclusively online without any physical branches.

2021 was a big year for neobanks, largely due to the increase in venture capital investments in recent years and COVID-19 accelerating the adoption of digital banking services, leading to increased demand for neobanks.

SimpleDirect was still in its early post-concept stage back then. We launched the initial SimpleDirect MVP in January 2020 and had been experimenting with it with a few home improvement businesses we were working with.

Interestingly, with seemingly $0 marketing budget, we managed to gather a few thousand homeowner applications for our personal loan products - which was a lot for a bootstrapped startup at the time.

This got us thinking: since we were seemingly popular with consumers, why not make an app that serves exclusively to consumers, so we could offer it to the thousands of customers already using our core products?

What is Evolve?

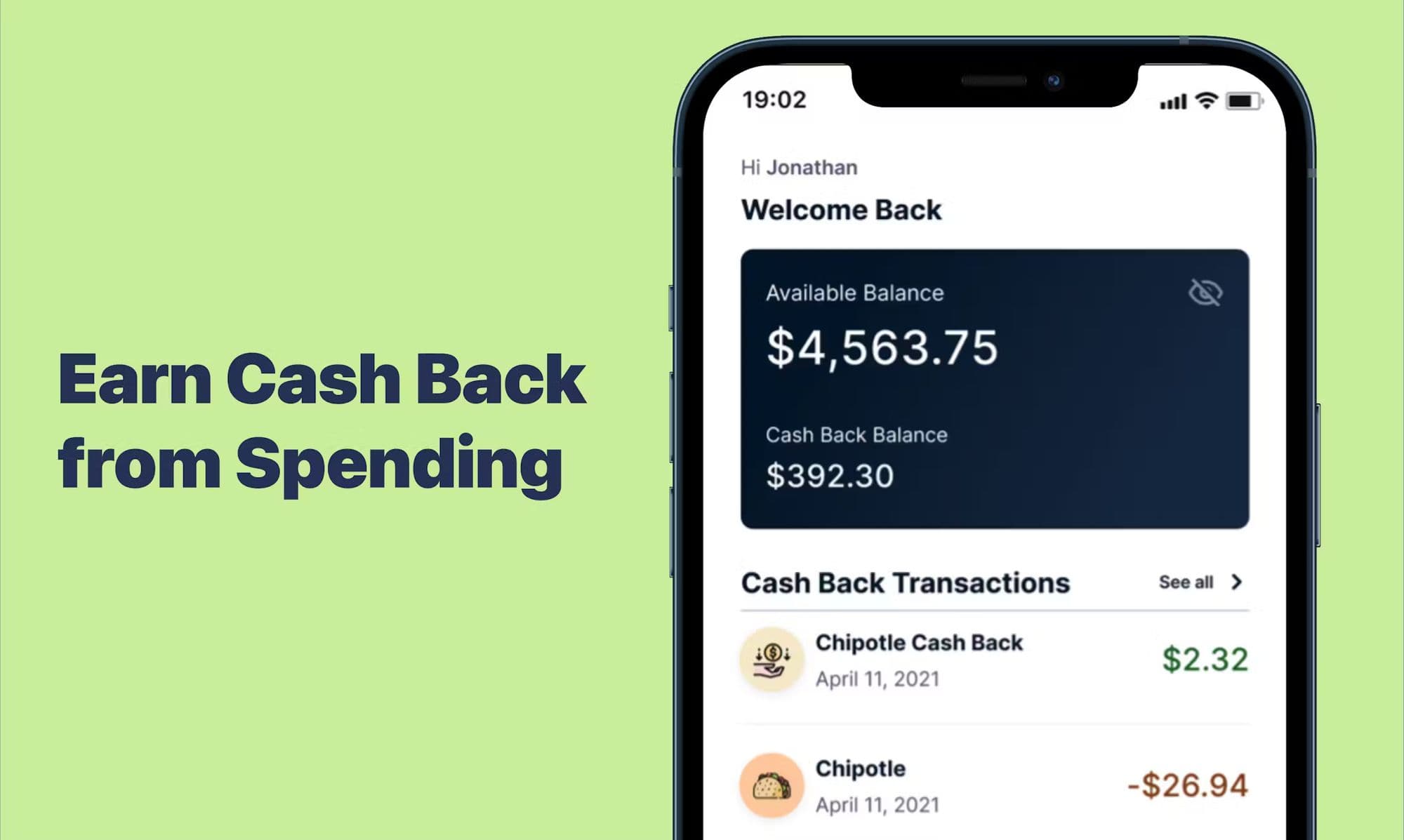

Evolve was our attempt at creating a neo-bank alternative. It was a mobile app that allowed users to connect their bank accounts and earn cash-backs from selected offers we displayed and changed on a semi-weekly basis.

The app was built as a proof-of-concept using Expo, Plaid, Node.js, and React Native. While we didn't integrate with a fin-tech partner or a bank, we aimed to prove the concept, grow the user base, raise additional capital, and eventually start charging interchange fees.

Design, Iteration, Fast to Market

Looking back, I have to give the then SimpleDirect team, led by our then COO Prajwol Bhandary and then CTO Arashdeep Panesar, a lot of credit. We had an idea, little budget, but filled with passion, we started building Evolve.

In just three months, we were able to:

- Design, code, and launch the marketing website.

- Built and launched the mobile app on both the Apple App Store and Google Play Store, overcoming publishing hurdles.

- Successfully launch on Product Hunt, getting over 391 sign-ups in the first 2 days, and overall, 1,200+ sign-ups in the first three months, which is a huge success for a consumer-based startup.

So why didn't it work?

Why Neo-Banks are Struggling Now

As of writing this blog post in 2024, 3 years after our initial launch of the Evolve app, most neo-bank startups are struggling because of:

- Profitability issues. Most struggle to retain profit due to the small 'interchange fees' (0.1%-0.2% of the transaction in 2021) and high costs of fin-tech maintenance, compliance, and regulatory hurdles.

- Intense competition and regulatory crackdown. The neobanks space has become quite competitive since 2021 with many new players. Fin-techs still need to work with licensed banks, which have to meet government approvals. This has become difficult after FTX's implosion, affecting the crypto sector the most, and now fin-tech as well.

Why Evolve Failed

Although those aren't the reasons Evolve failed. We built a quick prototype but launched a B2C app without a clear business model strategy. The idea was to prove the concept, grow, raise capital, and then start charging interchange fees.

The problem was we never thought about making money, but the infrastructure and third-party partnerships, especially Plaid, cost money - connecting new user accounts, refreshing user transactions, server costs, etc.

When we launched on ProductHunt, we were in the top 3 that day, which was amazing. We got a lot of interest, app downloads, and sign-ups.

About 1/3 of users connected their bank accounts through Plaid, incentivized by the promise of cash-back for purchases from our 'partners'.

We clearly stated these partners weren't working with us directly and we were just providing cash-back on those transactions.

In the end, with over a thousand customers and close to millions of lines of transactions pulled, we had no plan on how to monetize the app.

Ironically, we gave up early, noting it was more important to focus on SimpleDirect. The Evolve app was set aside, and after 1,100 users signed up, the sign-up feature stopped working.

Reflection: What Worked for Our B2C app

Let Users Be Your Champions

I chatted with a few B2C founders after Evolve failed, some backed by well-known VCs and some by YC. They were all quite surprised by our engagement metrics and how we got a thousand sign-ups in the first two months of launch with literally $0 spent on ads.

I think the key is to let your users be your champions and let them promote the app for you. We built Evolve to provide cashback to users for their debit cards because debit cards typically never pass on the cash-backs to users, even though the banks receive them.

We tackled this problem head-on to bring monetary benefits to users. One could argue 'giving away money to users' explains how we grew the user base quickly. However, I think the little 'gamification' methods I learned from reading a related book at the time also played a role - we did our best to make using the app fun, like playing an arcade game.

Let Users Refer and Utilize Referrals

One thing we did right was to include a referrals section, allowing users to refer others and get $5 for every new user who got referred, connected their bank accounts, and earned at least $25 cash back.

The requirement was set to reward the most loyal and active users who were helping us grow. We grew fast through referrals in the second month, with an estimated 1/4 to 1/3 of users coming directly through referrals.

Solve a Problem People are Passionate About

Even though we didn't find a way to be profitable, we were able to solve a problem that people are passionate about, and I believe that is the key.

People are sick and tired of the high cost of living and the fact that their bank does not pass on anything to them when they are making all the money and charging account fees. At the time, the message really resonated with a lot of users.

Fast Iteration

Even though we failed, we were able to iterate quickly in 3 months, launch, and fail. Looking back, this was a great experience and opened our door to B2C.

B2C is about solving problems. Years down the line, that's what will keep your company thriving while others decline.

What Didn't Work

Build it First, Think About How to Make Money Later

This could work. For example, Google was founded this way, with Sergey and Larry building the search engine first and thinking about monetization years later.

It just didn't work for us, especially as a fin-tech company. Due to the high costs of regulatory compliance and operating in the space, this could be fatal.

Follow a Trend

For most people, following a tech trend never goes well, whether it's VR/AR, neo-banks, crypto, or AI. If you're just building a company to chase a trend, there are several issues:

- The hype cycle can bust anytime and you'll get impacted.

- You need true passion to run a great company.

- There will be tens of thousands or more doing the same as you, and many may pull through.

Another Attempt? Maybe

Three years after launching Evolve, the team has some follow-on thoughts about solving a long-term, hopefully permanent problem that millions worldwide are facing. We're exploring ways to apply what we've learned to build something that's not following any trend, but focuses on problem-solving and helping consumers get ahead.

No decision has been made yet and it's probably down the line, but we're interested in picking up the topic again. Hence, I thought it might be helpful for other entrepreneurs to learn from the mistakes we've made.

Humbling experience, now let's build onward.